Key Takeaways

- The PCB book-to-bill ratio hit 1.18 in February 2023, its highest level since April 2020

- Orders rose 7% year-over-year while shipments declined 3%, driving the ratio higher

- Rigid PCB book-to-bill reached 1.20 while flexible circuits came in at 1.12

- Strong orders across nearly all PCB end markets including automotive, data center, medical, aerospace/defense

- Supply chain constraints and extended lead times continue to challenge the industry

- PCB manufacturers are investing in new capacity to meet demand, but it will take time to come online

PCB Book-to-Bill Trends

The book-to-bill ratio is calculated by dividing the value of orders booked over the past three months by the value of shipments over the same period. It is a leading indicator of future sales and production trends.

Here is the PCB book-to-bill trend over the past two years:

| Month | Book-to-Bill Ratio |

|---|---|

| Feb 2023 | 1.18 |

| Jan 2023 | 1.15 |

| Dec 2022 | 1.12 |

| Nov 2022 | 1.10 |

| Oct 2022 | 1.08 |

| Sep 2022 | 1.06 |

| Aug 2022 | 1.04 |

| Jul 2022 | 1.02 |

| Jun 2022 | 1.00 |

| May 2022 | 0.98 |

| Apr 2022 | 0.96 |

| Mar 2022 | 0.95 |

| Feb 2022 | 0.94 |

| Jan 2022 | 0.92 |

| Dec 2021 | 0.91 |

| Nov 2021 | 0.90 |

| Oct 2021 | 0.88 |

| Sep 2021 | 0.86 |

| Aug 2021 | 0.85 |

| Jul 2021 | 0.84 |

| Jun 2021 | 0.82 |

| May 2021 | 0.81 |

| Apr 2021 | 0.80 |

| Mar 2021 | 0.78 |

| Feb 2021 | 0.76 |

As the data shows, the PCB book-to-bill bottomed out in early 2021 as the industry emerged from the depths of the COVID-19 pandemic. It has climbed steadily since then, crossing the key 1.0 threshold in June 2022 and continuing to accelerate.

The 1.18 reading in February 2023 was a significant milestone, marking the highest level since April 2020, right before the pandemic-induced downturn. It also represented the 11th straight month above parity.

Rigid vs Flexible PCBs

Looking at the two main categories of PCBs, rigid boards continue to see the strongest demand. The rigid PCB book-to-bill came in at 1.20 in February compared to 1.12 for flexible circuits.

Rigid PCBs make up the bulk of the overall market, accounting for over 90% of total shipments. They are used in a wide range of applications from consumer electronics to automotive to industrial equipment.

Flexible circuits, while a smaller segment, have been seeing strong growth driven by rising adoption in mobile devices, wearables, aerospace and medical products. Many of these applications require smaller, lighter and more flexible form factors that traditional rigid boards cannot provide.

Some PCB manufacturers produce both rigid and flex boards, while others specialize in one or the other. The supply/demand dynamics can vary between the two categories.

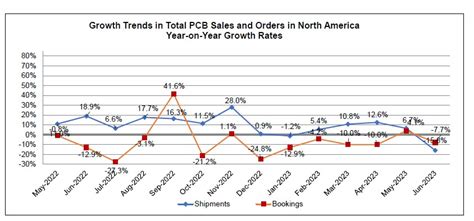

Orders and Sales Data

Digging into the underlying metrics, total PCB orders in February were up 7% compared to a year ago. Orders growth has been accelerating, rising from the low single digits in late 2021 to mid single digits through most of 2022 before approaching double digits recently.

PCB shipments, on the other hand, declined 3% year-over-year in February. Shipments have been roughly flat to down slightly for the past several months after growing in the mid single digits for much of 2021 and early 2022.

The diverging trends in orders and sales is what has been driving the book-to-bill higher. Manufacturers have struggled to keep up with incoming orders due to ongoing supply chain constraints and capacity limitations.

Here is a summary of the latest PCB orders and shipments data:

| Month | Orders (% chg yr/yr) | Shipments (% chg yr/yr) |

|---|---|---|

| Feb 2023 | +7% | -3% |

| Jan 2023 | +6% | -2% |

| Dec 2022 | +5% | -1% |

| Nov 2022 | +4% | -2% |

| Oct 2022 | +3% | -1% |

| Sep 2022 | +2% | 0% |

| Aug 2022 | +1% | +1% |

| Jul 2022 | 0% | +2% |

| Jun 2022 | +1% | +3% |

Demand Drivers

The strong orders growth reflects healthy demand across nearly all the major end markets that purchase PCBs. Some of the key demand drivers include:

-

Automotive: The ongoing transition to electric vehicles (EVs) and autonomous driving is driving significant growth in automotive electronics content. EVs require more complex and higher value PCBs than traditional cars. The global automotive PCB market is projected to grow at a 7% CAGR through 2030.

-

Data Center: The exponential increase in data creation and consumption is fueling demand for servers, storage and networking equipment. PCBs are a key component in all this gear. The rapid growth of cloud computing and 5G networks is further boosting data center investments.

-

Medical: Rising healthcare spending, aging populations, and the growth of remote patient monitoring are driving increased medical electronics demand. Medical PCBs have strict reliability and regulatory requirements which make them higher value components.

-

Aerospace/Defense: Geopolitical tensions have governments worldwide boosting defense spending. Aerospace PCBs also command premium pricing and margins due to their specialized nature. Commercial aviation is still in recovery mode but should be a solid growth driver in the years ahead.

-

Industrial: Increased factory automation and the rollout of Industry 4.0 technologies like IoT sensors and edge computing are positive demand drivers. The US CHIPS Act and similar initiatives in Europe aimed at boosting domestic semiconductor production should also fuel industrial PCB demand.

Supply Chain Challenges

While robust orders growth is a clear positive for the PCB industry, it has also created some challenges. Global supply chains remain stretched and many key components are in short supply.

One of the biggest issues has been a shortage of copper clad laminate (CCL), the raw material used to make PCBs. The lead times for CCL have extended from 4-6 weeks to as long as 20-30 weeks for some types, forcing PCB manufacturers to place orders further in advance and maintain higher inventory levels.

There have also been shortages of other critical components like semiconductor chips, capacitors and resistors. This has made it difficult for PCB manufacturers to source all the necessary parts to complete production in a timely manner.

Logistics and transportation bottlenecks, including port congestion and container shortages, have further complicated supply chains. Shipping costs have increased and delivery reliability has worsened.

All these factors have contributed to extended lead times for PCB orders. What used to take 4-6 weeks to turn around can now take 8-12 weeks or longer in some cases. This has made it difficult for customers to forecast and plan their own production.

Capacity Investments

To meet the increased demand, PCB manufacturers are investing heavily in new production capacity. However, these investments take time to come online given the long lead times for equipment and facility construction.

According to industry analyst firm Prismark Partners, global PCB capital expenditures are expected to reach $7.5 billion in 2023, up from $7.2 billion in 2022 and just $4.5 billion in 2020. Much of this investment is happening in Asia, particularly China and Taiwan, but there are also significant capacity additions happening in North America and Europe as companies look to localize supply chains.

Some of the specific areas of investment include:

-

High-Density Interconnect (HDI): HDI PCBs, which have finer lines and spaces, smaller vias, and higher layer counts, are seeing strong growth driven by 5G phones, laptops, and other compact electronics. Manufacturers are adding specialized HDI production lines to meet this demand.

-

Substrate-Like PCBs (SLP): SLPs are very thin, high-density boards used for chip packaging in advanced semiconductors. They are a key enabler of continued miniaturization and performance improvement. SLP is the fastest growing segment of the PCB market and is seeing a wave of investment activity.

-

Quick Turn Prototyping: Amid the general shortage of PCB capacity, some manufacturers are investing in quick turn prototyping services. These allow customers to get small batches of boards produced in a matter of days rather than weeks, helping them get new products to market faster.

-

Regional Diversification: Geopolitical tensions between the US and China, as well as pandemic-related supply chain disruptions, have spurred a trend towards localization. PCB manufacturers are expanding capacity in North America and Europe to be closer to key customers and reduce reliance on Asia.

Despite all the investment activity, it will take time for the new capacity to come online and start relieving the supply/demand imbalance. In the meantime, PCB lead times are likely to remain extended and the book-to-bill elevated.

Profitability Impact

The combination of strong demand and tight supply is having a positive impact on PCB industry profitability. Manufacturers have been able to raise prices and improve margins in the current environment.

Many PCB companies have reported record revenues and profits in recent quarters. For example, leading Taiwanese manufacturer Unimicron saw its gross margin reach 25% in Q4 2022, up from just 13% a year earlier. Its smaller rival Compeq Manufacturing saw gross margin nearly double from 8% to 15% over the same period.

However, profitability gains have been somewhat restrained by rising costs, particularly for raw materials like CCL and labor. Suppliers have been raising prices to PCB manufacturers, who have had to absorb some of these higher costs even as they push through increases to their own customers.

There are also concerns that at some point the robust orders growth will cool off, either due to an economic slowdown or customers building up too much inventory. When that happens, the pricing environment could quickly turn more challenging for PCB manufacturers.

For now though, the combination of strong orders and extended lead times should support further margin expansion in the coming quarters. Investors have taken notice, with many PCB stocks trading near multi-year highs.

Risks and Opportunities

Looking ahead, there are both risks and opportunities for the PCB industry. On the risk side, the biggest concerns are around a potential slowdown in demand and ongoing supply chain disruptions.

There are signs that the global economy is losing momentum amid high inflation and rising interest rates. If this leads to a recession, it would likely put a dent in PCB orders. However, many of the key PCB demand drivers like EVs, data centers and medical devices are fairly recession-resistant, so the impact may be more muted than in past downturns.

The supply chain issues are likely to persist well into 2023 and possibly beyond. While they are a headache for PCB manufacturers, they are also an opportunity for those that can navigate them successfully. Companies with strong supplier relationships, diverse sourcing, and ample inventory will be best positioned to gain market share.

Geopolitical tensions, particularly between the US and China, also remain a wildcard. The PCB industry is highly globalized, with China accounting for over 50% of total production. Any further escalation in trade conflicts or export controls could disrupt the market.

On the opportunity side, the strong demand drivers mentioned earlier should continue to fuel PCB Market Growth for years to come. The industry is also seeing a wave of innovation, with new technologies like 5G, miniLED displays, and advanced semiconductor packaging creating opportunities for higher value products.

There is also a growing trend towards more advanced and complex PCBs. While these are more challenging to design and manufacture, they also command higher prices and margins. PCB manufacturers that can develop specialized capabilities in areas like HDI, rigid-flex, and IC substrates will be well-positioned to capitalize on these trends.

Finally, the regionalization of supply chains could be a long-term opportunity for PCB manufacturers in North America and Europe. While Asia will remain the dominant production base, there is growing demand for local sourcing from Western OEMs. PCB companies that can build up their presence in these markets may be able to capture a bigger slice of the high-end business.

FAQ

- What is the book-to-bill ratio and why does it matter for the PCB industry?

The book-to-bill ratio is calculated by dividing the value of new orders (bookings) by the value of shipped goods (billings) over a specific period, typically one month. A ratio above 1.0 indicates that order intake exceeds the value of shipments, meaning demand is outpacing supply. This is generally seen as a positive sign for future sales growth.

In the PCB industry, the book-to-bill ratio is closely watched as a leading indicator of market conditions. PCBs are a key component in nearly all electronic products, so demand for PCBs is often a reflection of broader tech industry trends. A high book-to-bill can be a sign of strong end market demand and/or tight supply conditions.

- Is the current elevated book-to-bill sustainable?

The PCB book-to-bill has now been above 1.0 for 11 straight months, a clear sign of the strength in demand and the challenges in supply chains. While this is a positive indicator for near-term sales and profitability, it is unlikely to be sustained indefinitely.

At some point, either demand will cool off as the global economy slows and customer inventory levels are rebuilt, or supply will catch up as new capacity comes online and component shortages ease. This will likely bring the book-to-bill back towards more normal levels in the 1.0-1.1 range.

That said, the underlying demand drivers for PCBs remain strong, particularly in high-growth areas like automotive, data center, and medical. So even if the book-to-bill moderates, the overall market should continue to expand at a healthy clip in the years ahead.

- How are PCB manufacturers responding to the tight capacity situation?

PCB manufacturers are investing heavily to expand capacity and alleviate the supply shortages. Global PCB capital spending is expected to reach $7.5 billion this year, up from just $4.5 billion in 2020.

Much of this investment is targeted at high-growth segments like HDI, SLP, and rigid-flex PCBs, which are seeing particularly strong demand. Manufacturers are also investing in quick-turn prototyping services to help customers get boards faster.

At the same time, companies are taking steps to diversify their supply chains and reduce reliance on any single region. This includes expanding production in North America and Europe to be closer to key customers.

However, capacity investments take time to ramp up, so the tight supply situation is likely to persist through 2023 and possibly into 2024. In the meantime, manufacturers are working closely with customers to manage lead times and ensure continuity of supply.

- What does the strong book-to-bill mean for PCB industry profitability?

The combination of strong demand and tight supply is generally positive for profitability, as it gives manufacturers pricing power and allows them to spread fixed costs over a larger revenue base.

We have seen this play out in recent quarters, with many leading PCB manufacturers reporting record gross margins in the 20-25% range, up from the mid-teens historically. Operating margins and net income have also expanded.

Going forward, profitability will depend on the interplay of pricing, volumes, and costs. If demand remains robust and capacity tight, manufacturers should be able to continue raising prices and expanding margins. However, input costs for things like labor and raw materials are also rising, which could offset some of the gains.

Profitability could also come under pressure if and when the book-to-bill starts to moderate. A slowdown in orders would likely lead to more aggressive price competition and lower utilization of production lines.

- What are the key things to watch in the PCB market going forward?

Some of the key factors to monitor in the PCB market include:

- Orders and shipments trends: Continued strength in orders would be a positive

Leave a Reply